A set of connected devices that communicate with one another and an overall network to collect and exchange data using embedded sensors.

How Data Analytics is Shaping the Future of Freight Shipping

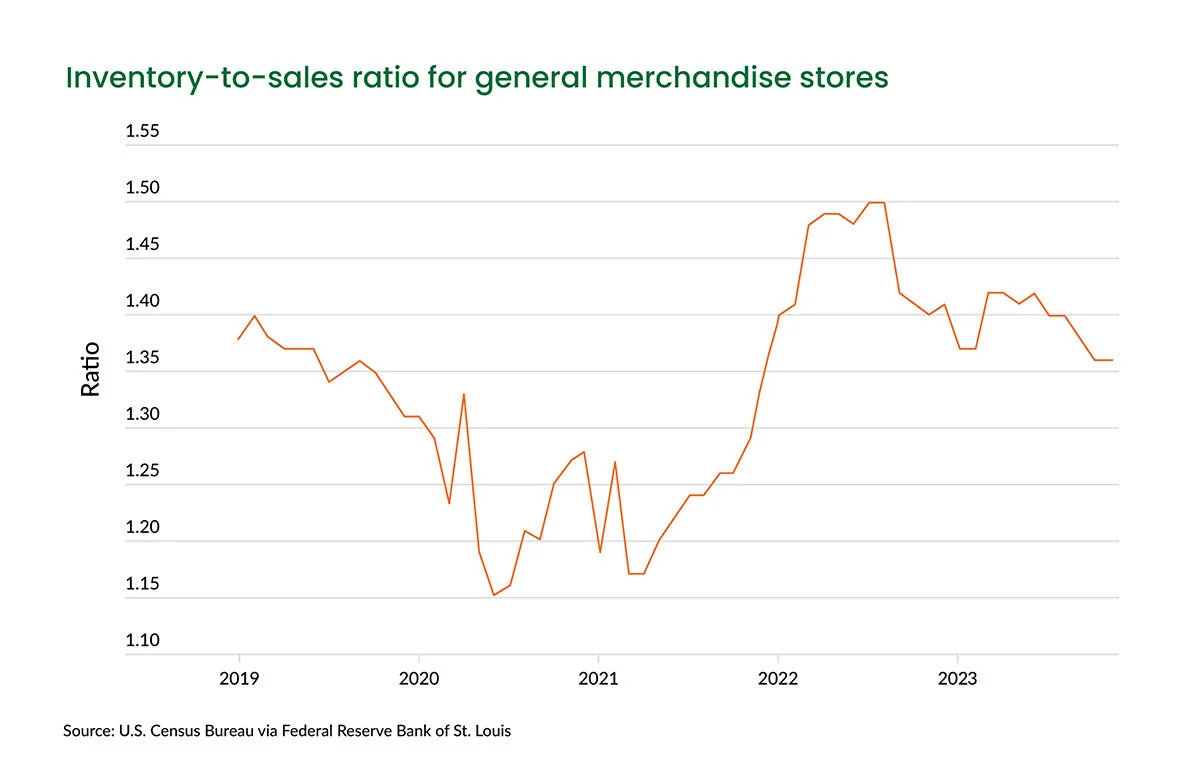

This dovetails with a new, more resilient “Just-In-Time 2.0” inventory philosophy that emerged in the aftermath of recent supply chain disruptions. After learning some important lessons, the domestic supply chain has rebuilt itself, retaining key advantages of the Just-In-Time model while prioritizing shorter, more resilient lines of transport with greater redundancy.

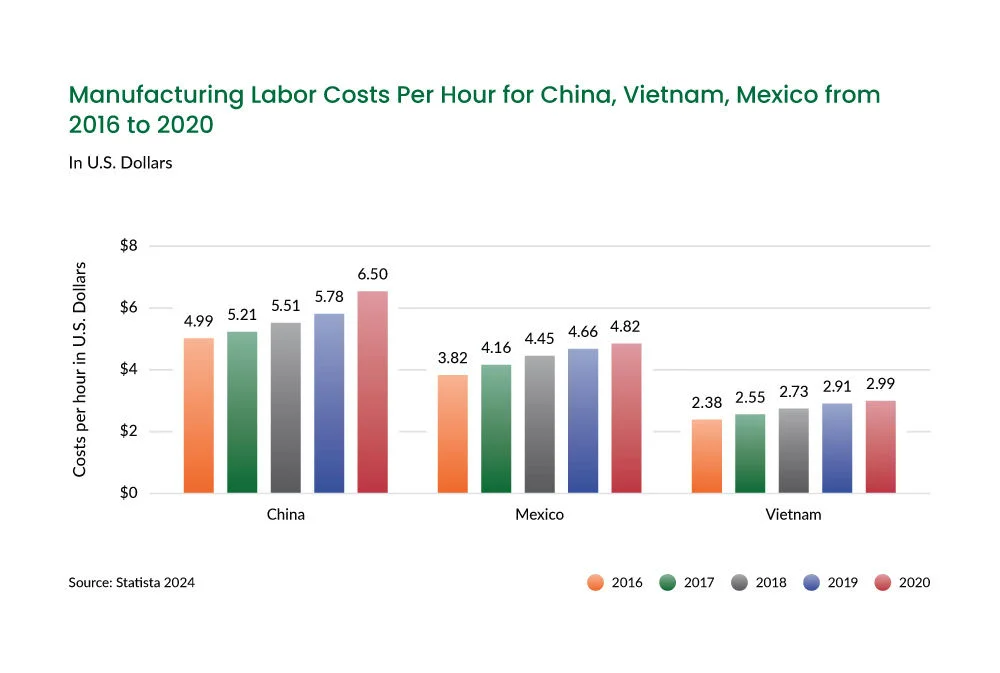

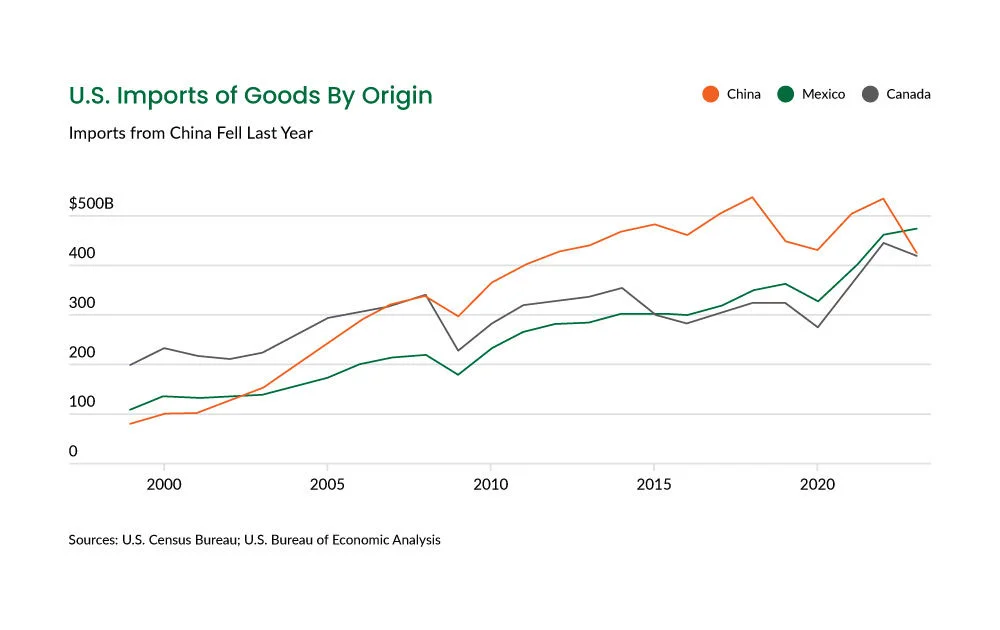

Key to this has been the robust move toward nearshoring supply from Mexico and Canada. This shift was predicted in the wake of the supply chain disruptions of 2020, but few expected it to happen so quickly, outpacing almost all estimates, especially in regard to Mexico. In 2023, with its labor prices now significantly below those seen in China, Mexico became the United States’ number one trading partner. The speed and flexibility of shorter, overland routes showed their advantages over sending freight across the Pacific.

The Consequences of Complexity

The Consequences of Complexity

As these four factors (demand prediction, B2B sector business expectations, JIT 2.0, and nearshoring) continue to shape the shipping landscape, they will combine to create a faster, more granular shipping market. Its defining features will be smaller, more frequent shipments and greater automation. It will also likely create greater demand for tighter delivery windows, freight that requires an appointment, and noncompliance penalties.

Thankfully, the technology revolution that drives all of this does not play favorites. A new generation of tools and standards has emerged to similarly supercharge the supply side of the shipping equation, making digital operations less expensive to implement and easier to use than ever before. Today’s best carriers are putting them to work every day across their fleets. APIs, artificial intelligence, and connected systems are now available to businesses at almost every level, making it easier to thrive than ever before, especially for companies that work with future-forward carriers.

Trend 1: AI and Data Analytics Are Reshaping Demand Prediction

Trend 1: AI and Data Analytics Are Reshaping Demand Prediction

Retailers have been conducting experiments in consumer-facing artificial intelligence for several years to enhance customer service and create new levels of personalization. Along the way, they’ve developed a deeper understanding of customer segments and spending habits, allowing them to further refine product development and selection. Success in these areas has inevitably led to AI deployment in businesses that serve retailers, including manufacturers and distributors. Demand prediction, inventory optimization, and warehouse management have all proved particularly ripe for reinvention, allowing retailers to simultaneously right-size inventory while remaining nimble and ready to act quickly based on market conditions.

Some product areas are static and well understood, but those with more volatile demand patterns are moving more quickly than ever thanks to the internet and social media

“Some product areas are static and well understood, but those with more volatile demand patterns are moving more quickly than ever thanks to the internet and social media,” says Dr. Robert Handfield, professor of operations and supply chain management at North Carolina State University’s Poole College of Management. “In the past, this was primarily a backward-looking exercise, but with the ability to see same-store sales data in real time, retailers can create forecasts that are automatically tied to changes in stock requests.”

On the manufacturing side, companies are using artificial intelligence (AI), machine learning (ML), and the Internet of things (IoT) to automate processes, predict maintenance schedules, manage quality control, and optimize production—a paradigm known collectively as Industry 4.0. These practices lead to a more precise understanding of supply needs, which then filters down into their logistics and supply chain operations.

In a 2024 McKinsey survey, 65% of respondents report they were using generative AI regularly, with 26% of consumer goods and retail companies investing more than 5% of their annual budget into generative and analytical AI. In addition, companies saw the most meaningful revenue increases from AI around supply chain management, with 53% of companies seeing revenue increases of 5% or more.

Key Terms to Know

A branch of computer science focused on systems that perform tasks which typically require human intelligence, including reasoning, learning, and self-correction.

A subset of AI that focuses on creating algorithms that automatically improve themselves through experience and data analysis.

The fourth industrial revolution, currently underway, refers to the integration of digital technologies into manufacturing, marked by high levels of automation and data exchange.

It’s worth underlining that this is not new commerce, but instead a shift in where commerce is happening. Overall sales remained flat in 2023, but ecommerce in the B2B sector grew by 17%. According to a Digital Commerce 360 study, 7 of 10 B2B buyers prefer to transact business online, rather than through conventional channels, and B2B ecommerce grew by 100% in 2023.

“The pharmaceutical industry adjusted to this years ago,” says Handfield. “Stores will get several shipments a week, and often when they order something it comes the next day. We're also seeing strategies that resemble omnichannel retail moving into the B2B space.”

As B2B begins to resemble B2C, purchasers are developing consumer-like assumptions.

"The way B2B buyers shop is changing, and B2B merchants need to adapt. Buyers are turning to online channels to research, compare and purchase products,” said Lance Owide, general manager of B2B at BigCommerce, a leading global ecommerce platform, said to USA Today. “B2B merchants need to have a strong online presence and offer a seamless omnichannel shopping experience to keep buyers loyal and converting — or risk losing market share.”

Retailers now expect faster speed-to-shelf times. They want each stop in the value chain to move faster and be both more efficient and resilient.

“Ecommerce changed everything,” says Handfield. “Millennials are now the decision makers in many of these businesses, and they expect to do business the same way they conduct everything else in their lives, digitally, with online ordering, faster shipping times, and low shipping costs.”

Key Terms to Know

Business transactions conducted between businesses, rather than between businesses and consumers.

Business transactions conducted between businesses and consumers.

The buying and selling of goods over the internet.

A sales approach that integrates multiple channels to provide a seamless experience across the web, apps, phone, and in-store interactions.

The faster things get, the nimbler folks have to be. We’re seeing a lot more last-minute shifts.

“We’re seeing people use analytics to get a whole lot smarter about inventory,” says Handfield. “They're ordering in smaller quantities and restocking more frequently, because they’re doing more market testing, using real-time data to better plan, forecast, and predict, in order to lower carrying costs. The brands still sit down with retailers and plan the year in advance, but as they get closer to sell-in dates, they continue to refine and update those plans, based on new data coming in.”

As major retailers begin using real-time sales and predictive analytics to predict demand more accurately, they no longer need to carry as much shelf stock of each item they sell. This allows them to place smaller orders more frequently. Where a grocery chain might have needed two facings of a popular item in the past, they might find they can drop to a single facing, ordered twice (or slightly more or less than twice) as frequently. This trend will in turn put pressure on manufacturers, who may need to create different case sizes to accommodate different retailers, and lead to capital costs for retooling production lines.

“The faster things get, the nimbler folks have to be,” says Todd Polen, Vice President of Pricing Services at Old Dominion Freight Line. “We’re seeing a lot more last-minute shifts. But when we’re connected directly to the customer via back-end APIs it makes changes like this much easier.”

Key Terms to Know

A logistics strategy that aligns order deliveries with production schedules and customer demand to minimize inventory levels.

A logistics methodology that corrects for the “drift” of the concept of Just-In-Time (JIT) shipping over the last several decades. Originally, JIT shipping was designed to reduce inventory carrying costs by delivering smaller shipments precisely when they were needed, based on demand signals, either from a retailer or a manufacturer. As supply chains lengthened and stretched across oceans, the definition of Just-In-Time became fuzzier. In many cases suppliers and receivers operated on the principle of Just-In-Time, but over distances that took weeks or months to travel. The system functioned adequately, until the COVID-19 pandemic revealed the fragility that had crept into the system over time. JIT2.0 allows retailers and manufacturers to return to the low inventory levels they prefer, but shortens supply chains, increasing flexibility and resilience.

Data points that indicate current customer demand trends, typically used to optimize inventory and production planning, or trigger automated delivery orders.

Nearshoring is having a significant impact on the U.S. trucking industry including the LTL market

In 2023, 88% of small- and medium-sized businesses planned to transfer some of their business to Mexico. 45% planned to transition all of it. Also in 2023, Mexico replaced China as the United States’ top trading partner, growing 30% since 2019.

The trend toward manufacturing in Mexico is clear. The Mexican Association of Private Industrial Parks recently revealed plans to develop 50 new industrial parks, which are expected to begin operation in 2024 and 2025. Goods coming from Mexico are not subject to the bottlenecks, disruptions, and spiraling costs of ocean shipping. Traffic through the world’s two most important canals has slowed. The Suez canal is beset by armed unrest, while Panama is facing severe drought which has dramatically lowered its canal’s throughput due to lack of water for its locks. Given these conditions, short, overland transits from Mexico look ever more attractive.

“The increased speed of commerce is pushing retailers toward closer suppliers and shorter supply chains,” says Handfield. “If you try to source something based on a social media trend from China, you’re going to get it two months later, probably after the trend is over. Then, you take a bath when you offload your merchandise to the overstock stores.”

“Forward-thinking carriers have been building infrastructure and capacity along the southern border for years,” notes Greg Plemmons, Executive Vice President and Chief Operating Officer at Old Dominion Freight Line. “There’s an art to moving goods across the border. It takes more than just trucks and drivers. You’ve got to know the territory, know the regulations, and the language. But, it’s become an extremely attractive option for many of our customers over the past few years.”

“We’re seeing a more finely sliced-and-diced market, with more distribution centers of smaller size, with more, smaller shipments moving between them more frequently,” says Handfield. “Basically, the whole market becomes higher resolution. When that happens, your visibility increases. The trick is to do it without the details becoming overwhelming. What’s clear though is that AI and analytics are making companies want to move smaller shipments, from smaller distribution centers, on smaller vehicles, more often.”

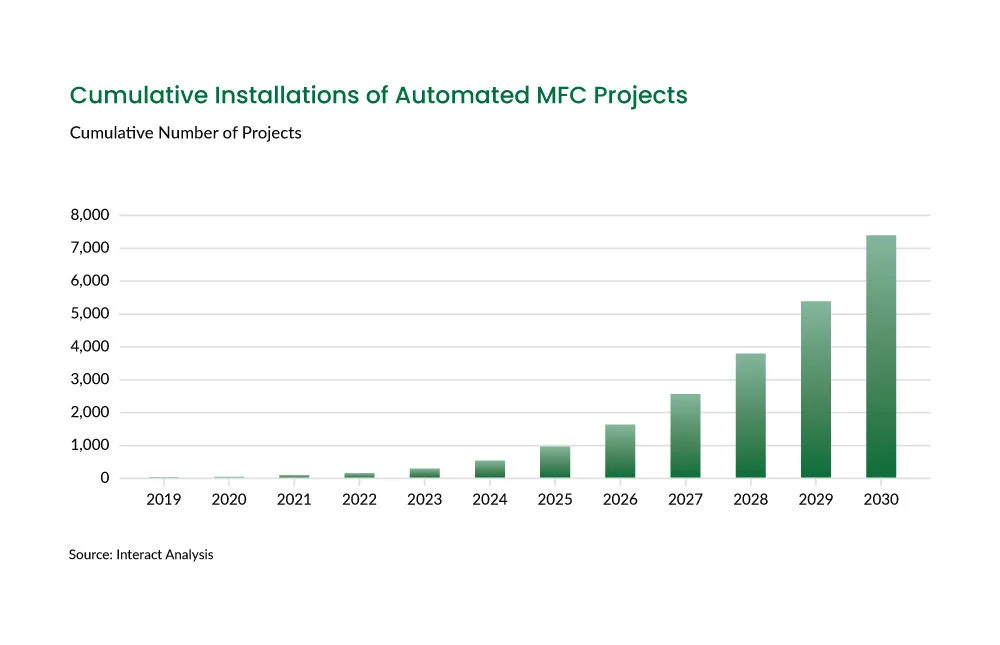

One place this trend can be seen is in the advent of Micro-Fulfillment Centers (MFCs), smaller warehouses (typically 5,000-25,000 sq. ft.) typically located in urban or suburban areas. MFCs often use robotics to reach high levels of automation. They are also designed to scale, providing flexibility based on product demand. Estimates say that annual MFC installation will grow as much as 20 times by 2030. Much of this capacity is expected to be used by grocery omnichannel and ecommerce players. This model has been adopted from the leaders in ecommerce fulfillment, including Amazon, Walmart, and Kroger, who often deploy MFCs close to or even co-located with retail stores.

![]() “Our stores are our most valuable asset,” says Gretchen McCarthy, chief of supply chain logistics at Target on a Wall Street Journal podcast. “We saw an opportunity to leverage them as mini fulfillment centers.” Target also continues to install new large-scale “flow centers,” along with smaller-scale “sortation centers,” which serve 30-40 stores within a region.

“Our stores are our most valuable asset,” says Gretchen McCarthy, chief of supply chain logistics at Target on a Wall Street Journal podcast. “We saw an opportunity to leverage them as mini fulfillment centers.” Target also continues to install new large-scale “flow centers,” along with smaller-scale “sortation centers,” which serve 30-40 stores within a region.

Key Terms to Know

A small, often automated warehouse designed to fulfill online orders rapidly, often located near urban areas.

Smarter + Faster + Shorter + Denser = Increased Compliance Obligations

Smarter + Faster + Shorter + Denser = Increased Compliance Obligations

All these factors in manufacturing and retail—digitization, data analytics, AI, consumerization, and nearshoring—will combine in the coming years to significantly affect the way shippers are asked to work with their customers. Smaller shipments will be requested more often, requiring faster response times. Alongside this, we are also likely to see greater expectations of accuracy and tighter delivery windows. This increase in freight requiring delivery appointments will help retailers boost their precision and flexibility but creates a heavier organizational burden on shippers and their carriers.

Over the past decade, there has been a substantial increase in the requirement of delivery appointments in LTL freight. The need for more specific delivery windows increases operational complexity, and not every carrier is up to the challenge.

On Time, In Full (OTIF) requirements have been on the rise for the past decade, starting with big box retailers, before expanding to ecommerce companies, grocery chains, home improvement stores, and pharmacies. We expect these categories to expand further, as the majority of businesses adopt these aggressive, competitive, digitally-driven business strategies.

Retailers’ shipment windows have gotten narrower and narrower, and the penalty fees for compliance have also grown.

“Retailers’ shipment windows have gotten narrower and narrower, and the penalty fees for non-compliance have also grown,” says Norman Katz, author and consultant at Katzscan, Inc. “It makes it harder for small brands to operate. They end up having to hold more inventory in order to meet requirements.”

“Additional charges on freight can destroy a company’s profit margins,” says Plemmons. “Shippers need to be able to rely on the prices they are quoted, and the delivery time they are promised. And that means working with a carrier with enough capacity and redundancy to guarantee on-time, in-full deliveries.”

Key Terms to Know

A shipping paradigm in which delivery times are scheduled for specific, agreed-upon arrival windows.

A performance metric which rates a delivery based on whether it arrived complete, and within a specific, scheduled time window.

To Stay Ahead of Digital, Become Digital

To Stay Ahead of Digital, Become Digital

While demands on shippers have never been higher, the same digital tools and techniques that enabled this new reality provide important countervailing benefits for shippers. The barrier to digitizing shipping operations has never been lower, while the benefits have never been higher. The industry seems to understand this as well.

“Digitization is being democratized, and that is creating a tremendous amount of opportunity,” says Barry Craver, Vice President of Technology at Old Dominion Freight Line. “For the businesses bold enough and determined enough to seize this moment, it’s very exciting. There are new levels of precision and efficiency available to small and medium-sized businesses that were previously only available to the largest companies.”

Indeed, in a purely digital system, shipping systems can be tied directly to inventory systems, increasing accuracy on both ends, and speeding up invoicing and payment times from clients. Many complex or repetitive processes can be automated either partially or wholly. When compliance disputes arise, documentation is available at the touch of a button for faster remediation.

Digitization is being democratized, and that is creating a tremendous amount of opportunity.

“There is some upfront effort needed to amass good data,” says Handfield. “But once you have it, it can be combined with other data sources to provide amazing insights, market analysis, category strategy, or inventory policy.”

The exponential increase in data analytics, fueled by the AI boom, is finding its way into almost every aspect of business. This is a technological shift on the level of the introduction of television or smart phones. It will open up entirely new ways of doing business, while creating unprecedented efficiencies for suppliers, manufacturers and retailers alike. And the good news is, it’s in its infancy, meaning, for now at least, the playing field is level.

The Time Is Now

The Time Is Now

If you are not yet operating at a high level digitally, you are not alone. Only a small percentage of businesses are taking advantage of these tools currently. Without a doubt, the pace of change is quickening. Companies that do not act soon risk being outpaced by a marketplace set to go into overdrive. The good news is, there has never been an easier time to begin taking advantage of these tools.

In Summer of 2023, the NMFTA created new standards to simplify the process of creating API connections between shippers and carriers, while the LTL Digital Council announced its unified EBOL API standards, backed by a wide range of carriers (including Old Dominion).

Additional efforts by carriers and the industry as a whole have made the leap to digitalization easier, and put more resources at shippers’ disposal.

Working with a carrier who understands the digital landscape and can help guide you through the process of digitizing, automating, and streamlining your shipping processes makes all the difference. The world has never been more uncertain, but the most powerful advantage in an uncertain time is the confidence to act. Digitization, analytics, automation, APIs, and artificial intelligence can give you the certainty you need in an uncertain time.

Understanding where you are, defining where you want to go, and prioritizing the different aspects of your transformation are the critical first steps in finding a way forward in today’s transportation market.

Key Terms to Know

A set of rules and protocols that allows different software applications to interact with one other, and pass data between them.

A style of API software architecture used to facilitate communications between network applications, typically using the HTTP protocol.

A protocol for exchanging information between web services, using the XML data format.

A standard for exchanging business documents and data electronically between organizations.

A digital version of a bill of lading document, managed and transferred electronically before, during, and after delivery of goods.

The Old Dominion Difference

For more than 90 years, Old Dominion has been helping the world keep its promises. Be ready to meet any opportunity with an LTL shipping partner who can meet any demand.

With an industry-leading on-time record and low claims rate, our premier LTL shipping service ensures your shipment is delivered on time and damage-free. Solving your complex shipping problems is always our goal. At Old Dominion, your business is our business, and we make ourselves readily available as true shipping partners.

Our broad range of services and dedicated team members are backed by state-of-the-art technology, and we’re ready to build custom solutions to precisely match your business needs. Our digital integration team is ready to meet you wherever you are on your digital journey, whether you are getting started with eBOLs or looking to optimize your API integrations to strengthen and augment your service offerings.

Rush shipping? No problem.

Vendor scorecard compliance? We can help.

Just-In-Time inventory management? OD will help you keep your promises to customers.

OD ranks #1 in flexibility of operations among all national LTL carriers. From standard LTL to expedited shipping and everything in between, we offer a range of freight solutions to meet any business need across every region of the United States and North America. Contact us today to start working with the #1 National LTL Carrier for Quality as awarded by Mastio & Company for 15 years running. We’ll create a custom LTL freight solution to match your exact business needs. Our Solutions Specialists are ready to help.

If you are interested in working with OD, email us at Customer.Service@odfl.com for a response within 24 hours, or call us directly at 800-235-5569.